How to Go Into Debt

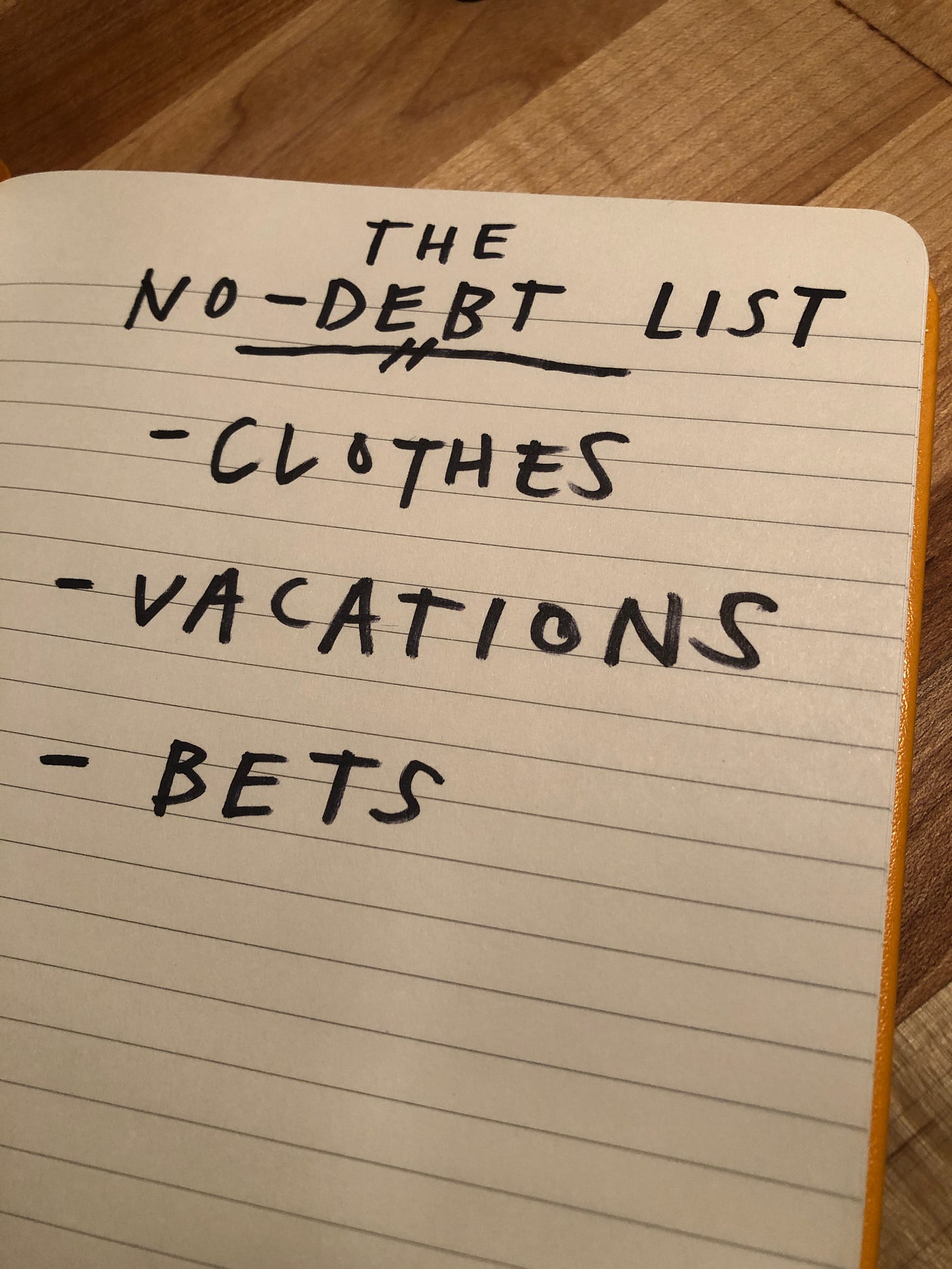

Like savings and retirement, you should have a game plan to go into debt.

Americans love household debt. We hold $14.35 trillion of it nationwide, according to a November report from The Federal Reserve Bank of New York. Yet we also hate debt. Through the third quarter of 2020, our credit card balances fell $86 billion. Why? For one, we went out less in the pandemic. There were fewer card swipes at Olive Garden, fewer trips to Six Flags put on Dad’s credit card. We’ve been paying down debt more than before, some of it with help via the CARES act. That makes sense. In times where your future income is less than certain, a ballooning credit card balance is a spooky thing.

But debt isn’t always bad. Do it right and you can use it as a tool to improve your family’s life. “There are some very clear times when it makes sense to go ahead and take on some debt,” says Calvin Williams, CEO of Freeman Capital in Atlanta. Here are a few:

Housing.

If you’re buying in a hot area — or a place that’s soon to be one, real estate can be great. You know this. Mortgages are at all-time lows, while values continue to rise. “Leveraging real estate in a high-growth area has been one of our best recommendations,” says Meghan Railey, founder of Optas Capital. Credit-wise, it’s best to have a down payment of twenty percent or more, to avoid PMI, or private mortgage insurance, an extra charge that protects your lender. To make sure you’re getting the best terms, shop around. Even if you have a personal relationship with your lender, get a couple other quotes. Your lender expects it, and you could save hundreds of dollars a month. And if you’re willing to do the work (and don’t mind being called a landlord), it can make sense to incur debt on a second home, too, for additional revenue and long-term appreciation.

A car.

If you can pay cash for a reliable car you like, you should do so for a simple reason: a new car depreciates the moment you leave the lot. At some point in a loan, you’ll likely owe more on the car than it’s worth. There are a myriad of bad ways to buy a car on credit, and one of the worst is increasingly popular: the 84 month (or longer) loan, a term that allows buyers to buy a flashier car for a lower monthly payment. But do it smartly and financing a car can be a good thing. “If having a car is key for you to build wealth, it can make sense to go ahead and finance,” says Williams. That especially makes sense if you’re looking at a 0% APR deal currently offered on some models by manufacturers from Ford to Mercedes-Benz. Of course these ultra-low interest rates are only available to those with excellent credit — a great reason to maintain good credit hygiene. Check your score periodically and deal with any issues.

School.

Well, here’s a loaded issue. Does it make sense to take on student loans to pay for a degree? In some cases, yes. “Student loans can be a positive thing if you can use them for a degree and experience that will translate that student loan debt into higher income and potential,” says Williams. If you’re transitioning mid-career into a growing and monied field, a la tech, the value proposition might make sense. If you’re thinking of going into debt for a $220K degree from Columbia’s Graduate School of Journalism, well — that’s a tougher case in 2021.

Your New Business.

It’s more precarious than a student loan in the will-it-ever-pay-off department, but sometimes you have to bet on yourself. Calvin Williams did it when starting Freeman Capital, an Atlanta-based firm targeting black and brown millennials. “I was willing to do whatever I had to do to get to where we are now. But it was incredibly risky,” says Williams. When deciding to put needed materials or services on your credit card for your side hustle — or your new self-employment gig — make sure you’re doing so on a card with the best rate possible. And then, of course, make sure to bust your ass. It’s all on you.