Do I Really Need to Prepare for a Financial Crash?

Yes, we might be in a bubble. But don’t panic — just get balanced.

Jesse Will is an Austin, Texas-based journalist and dad who has contributed to The New Yorker, Rolling Stone, The Wall Street Journal, Men's Journal, Pitchfork, Popular Science, Road & Track, and others. He’s not a financial genius, but like so many parents, he’s here to learn.

If you are, as I am, trying to use 2021 to get your financial house in order — paying more attention to both your bank statements and where the markets are headed — then you might feel a bit dizzy. Drive around your neighborhood. Does it look like the economy is going gangbusters? Unless you’re looking at the parking lot of say, Home Depot, or a grocery store, COVID has put a damper on everyday commerce. Here in Austin, Texas, where a booming tech industry has insulated the metropolis from the most severe economic damage, there are still shuttered businesses everywhere, dust-specked store windows frozen in time. Yet as I write this, there’s a news alert on Twitter that the Dow is at an all-time high. We’re barely a month removed from a moment in time where Gamestop stock hit $420.69, and Redditors went bonkers. In 2020, Tesla stock ballooned 695%, contributing to the S&P now trading at earnings projections pretty damn close to where they were before the dot com bubble burst in 2000.

Sure seems bubble-y. And if you want to avoid pulling up your 401(k) or IRA account this year and seeing a thirty percent drop, you might be starting to consider your strategy. What’s the normal guy to do? Is it time to move stock investments to cash? Go big on Bitcoin? Sock silver dollars away under the bed? I called up a guru — Julia M. Carlson, Founder and CEO of Financial Freedom Wealth Management Group in Newport, Oregon — to guide me through the uncertainty.

First off, she says I’m not alone. “I think there’s a disconnect between what the everyday American thinks about the markets, and what the markets are doing. In our small communities, we see going out of business signs, then we look at the stock market and think, ‘How can it be at all time highs?’ So one thing I remind my clients about is most of those small businesses you’re seeing shuttered aren’t the publicly traded companies we’re investing in. The stay-at-home stocks and tech stocks have driven the market. That being said, it can't keep going like it's going forever.” Even though the bull market might have some legs, especially considering more government stimulus is likely on its way, Carlson says that it’s the perfect time to be reflecting on your next steps. Here are a few prudent steps to get sure footing as the wildness of 2021 plays out:

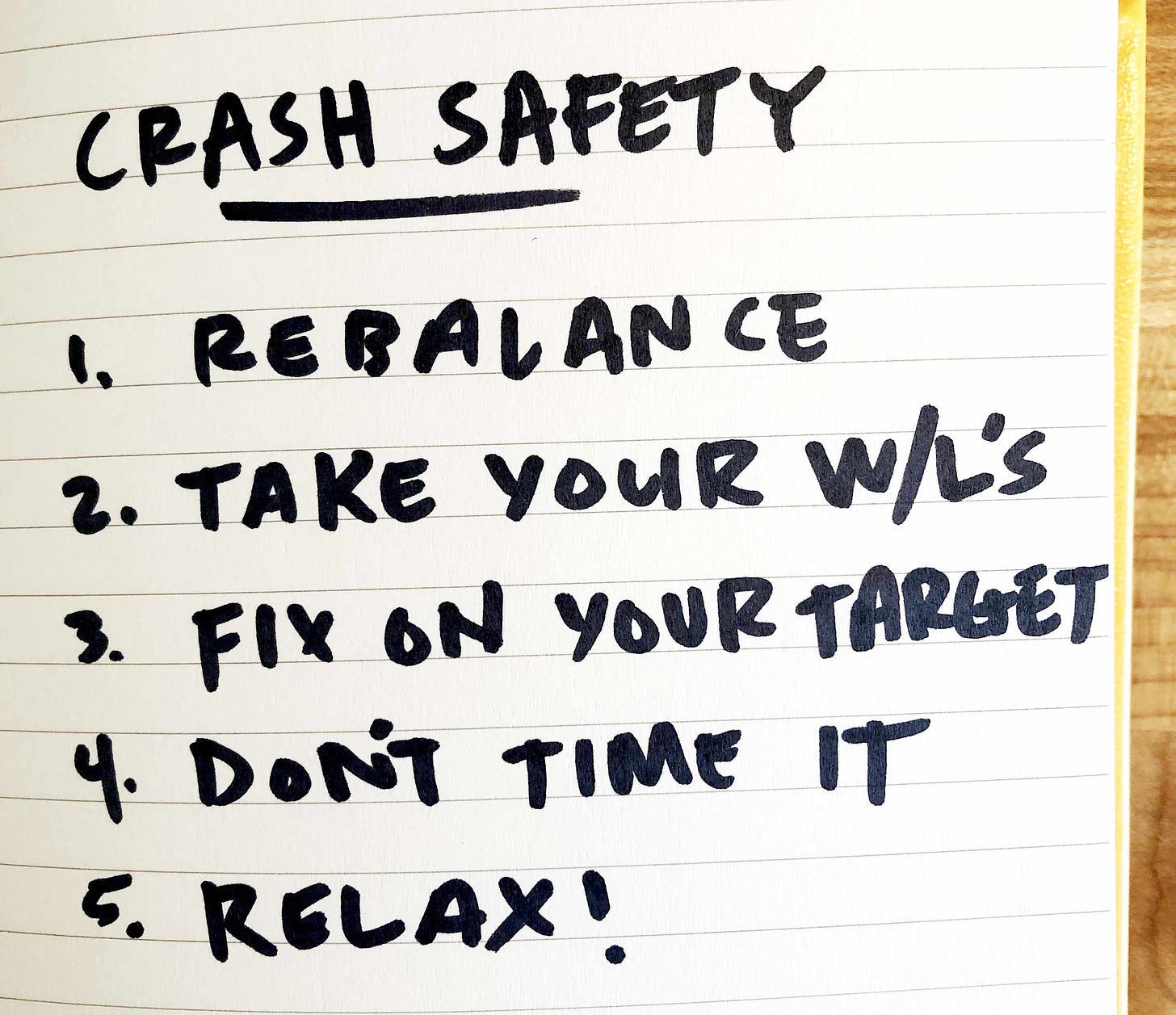

1. Look at your retirement account and rebalance it if necessary.

“You need to get into your 401K and make sure you’re enrolled in a rebalancing tool — almost all 401Ks have them nowadays,” says Carlson. (This is also true of the Robo-Investing services I covered in this column last week.) If you have a more hands-on approach and have benefitted through investing in tech-centric funds which have had outsized gains over the past year, great. “You may want to put that profit into areas that haven't performed as well: value companies and small and mid-cap funds that have just started to perform in the last six weeks or so,” says Carlson. In other words, buy low to sell high.

2. Did you make some bets last year? Might be time to fix them.

Did you make a small bet on Tesla that made you a bunch of money? It might be time to take profits. Did the neighbor dudes convince you to get in on some AMC or Nokia stock, or the ultra-hot ARK funds? Might be time to move for the exit. “You might have doubled your money, and that’s great,” says Carlson. “But as a general rule of thumb, I’d say that 10% of your investments should be in those really aggressive funds or individual stocks.”

3. Make sure your portfolio is targeted for your retirement timeframe.

Carlson tells me that it’s helpful to think about how I would feel if I looked at my account one day this year and saw that it took a thirty percent drop. Would I be able to survive? Yup. I have two decades to go until retiring. But if you are, say, five years away, you want to make sure that are thirty to forty percent (or more) invested in bonds or alternatives that are not correlated to the market — that way if the bubble bursts, you’re somewhat insulated.

4. Don’t try to time the market.

Let’s say you expect the market to make a dip or a correction sometime soon, and it will present you with a great investment opportunity to buy some of your preferred stocks, funds, or ETFs at a discount. It’s a great idea, in theory, says Carlson, but in reality, pretty hard to pull the timing off, and generally not worth holding cash on the sidelines to do. “Some active traders kind of like to play that game, but it's hard. We may, we may not have a dip. If we have if we get more stimulus money into these markets, then we could just keep charging ahead.”

5. Stop worrying.

Unless retirement is imminent and if you have a balanced portfolio, it’s not worth worrying about whatever short-term hit the market doles out, should there be a correction. “There are always going to be ups and downs to the market,” says Carlson. And she notes that during the last correction last March — those that did nothing are now doing quite well. Those that panicked and sold at the bottom are now regretting it. So take a deep breath…and let the uncertainty continue. Into the unknown!